Column: Gordon Campbell, 21 November 2013

Gordon Campbell on the latest failure of regulatory oversight of Anadarko

by Gordon Campbell

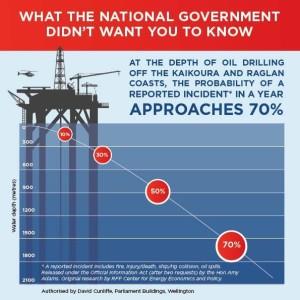

The controversial Texas oil company Anadarko are due to commence exploration drilling off the coast of Raglan this week. Now, you would think that any public concerns about its activities – say for example, over the adequacy of the company’s response plans in the unlikely event of a blowout – would be being openly dispelled via a public discussion of the plan’s merits. Unfortunately, that has not been the case. Our Environmental Protection Authority (EPA) is required by law to have vetted and approved Anadarko’s plan to cope with a blowout/cleanup situation – instead, the EPA has seen merely an “overview” of this document, which has been viewed instead by Maritime New Zealand. Here’s how the Environmental Defence Society(EDS) has described the current situation:

EPA Chief Executive Rob Forlong has advised EDS that “Anadarko provided us with an overview of their Discharge Management Plan as an appendix in both their Taranaki and Canterbury Impact Assessments. The full emergency response plan is contained within an annex of the Discharge Management Plan that Maritime New Zealand approved on the 15th of November”.

“By failing to even see the company’s full plans to deal with an oil spill, the EPA is failing in its statutory duty to confirm the completeness of the EIA. Moreover, Maritime New Zealand has failed to act transparently with its separate approvals process and intends making a decision about whether to make the Discharge Management Plan and Emergency Response Plan available only after drilling has started. This is unacceptable. It means the public has no idea what arrangements have been made to respond to an oil spill and whether they amount to best practice or something less.

This isn’t nitpicking. The EPA has a statutory duty under the current legislation to see and approve such plans. Moreover, what kind of message will this apparent non-compliance by our regulators with their own rules be sending to Anadarko? Right from the git-go, our regulators evidently can’t be bothered to observe the simple steps set out in the legislation that is meant to monitor the activities of oil companies drilling in deep water locations off our coastline. Not only did the EPA outsource its responsibility to Maritime New Zealand, which has no statutory power to vet the document. In addition, Maritime New Zealand has buried the document in question until after drilling has started. Given the workings of the Official Information Act, the document in question is unlikely to emerge into daylight until mid-December, at the earliest. If the spill response plan is adequate, why hide it?

It is not as if Anadarko does not need to be strictly monitored. Their current offshore exploration spill response plan may be terrific, top notch, best industry practice stuff – but the point is, we shouldn’t be being forced to take that on faith. The infamously inadequate Deepwater Horizon oil spill response plan (for which Anadarko shared joint responsibility with BP) was described by the Congressional Energy and Commerce Committee investigation as being “tragically flawed” and “embarrassing….” Similarly, the related technical and operational breakdowns that culminated in the resulting oil spill were found to be due to the “lack of a suitable approach for anticipating and managing the inherent risks, uncertainties, and dangers associated with deepwater drilling operations and a failure to learn from previous near misses.” In its Interim Report, the Congressional Energy Committee expressed particular concern about the “lack of a systems approach that would integrate the multiplicity of factors potentially affecting the safety of the well, monitor the overall margins of safety, and assess the various decisions from perspectives of well integrity and safety.” In its final report, the Committee stressed that joint responsibility (between Anadarko and BP) existed:

“A series of questionable decisions in the days preceding the blowout . . . had the effect of reducing the margins of safety and . . . evidenced a lack of safety-driven decision making,…The actions, policies, and procedures of the corporations involved did not provide an effective system safety approach commensurate with the risks….. The lack of a strong safety culture resulting from a deficient overall systems approach to safety is evident in the multiple flawed decisions that led to the blowout. Industrial management involved with the Macondo well/Deepwater Horizon disaster failed to appreciate or plan for the safety challenges presented by the Macondo well.”

And again, in the Final Report:

“Neither [of] the companies involved . . . made effective use of real-time data analysis, information on precursor incidents or near misses, or lessons learned in the Gulf of Mexico and worldwide to adjust practices and standards appropriate.”

Ask yourself. Is this the kind of operator that in 2013, any competent regulatory body would decide that hey, it should be quite OK to flag the need to see the relevant oil spill response plan, and that a mere “overview” of it should do the trick – while entrusting someone else (i.e., Maritime New Zealand) to run their eye over it, on the understanding that they will hide it from public view for as long as possible ? Instead of acting as public watchdogs, the regulators – and the Key government – appear to be operating in collusion with Anadarko. As a consequence, all the risks are being borne by a public that is being kept resolutely in the dark.

The asset sales referendum is nigh

Latest share market situation: shares in all the companies floated so far – Mighty River, Meridian and now, Air New Zealand – are performing below the price when floated. Meanwhile the cost of the sales process is climbing above $250 million. What a fiasco. So do remember to vote in the asset sales referendum starting this weekend – and to actively ensure that your friends and relations not only fill in the ballots, but put them in the post. Collecting the ballots and posting them on their behalf would be one way of countering the tendency often noted with postal ballots…whereby people will complete the forms, but then forget to post them. Everyone has until December 12 to do so.